OPEC: Signs Of A Major Oil Deficit

Summary

- Based on the data provided, the picture for investors interested in the crude space is looking bullish.

- There has been a large implied deficit in the past and there still is one this year.

- Some risks exist on this front, but they are unlikely to come to fruition, while other risks could push prices higher.

- Looking for a community to discuss ideas with? Crude Value Insights features a chat room of like-minded investors sharing investing ideas and strategies.

The big three determinants of the health of the oil industry today are 1) global demand, 2) US output, and 3) OPEC output. Each month, OPEC as an organization releases their own forecast for how the oil industry looks, and while they don’t forecast their own production as a team, they do provide a look at recent months that gives market participants a view of how much oil has been produced and what it means for the global market. In its most recent report, the group targeted April’s production, which came in about flat compared to a month earlier. But when combined with global demand, illustrates a very bullish picture for investors moving forward.

OPEC production flatlined

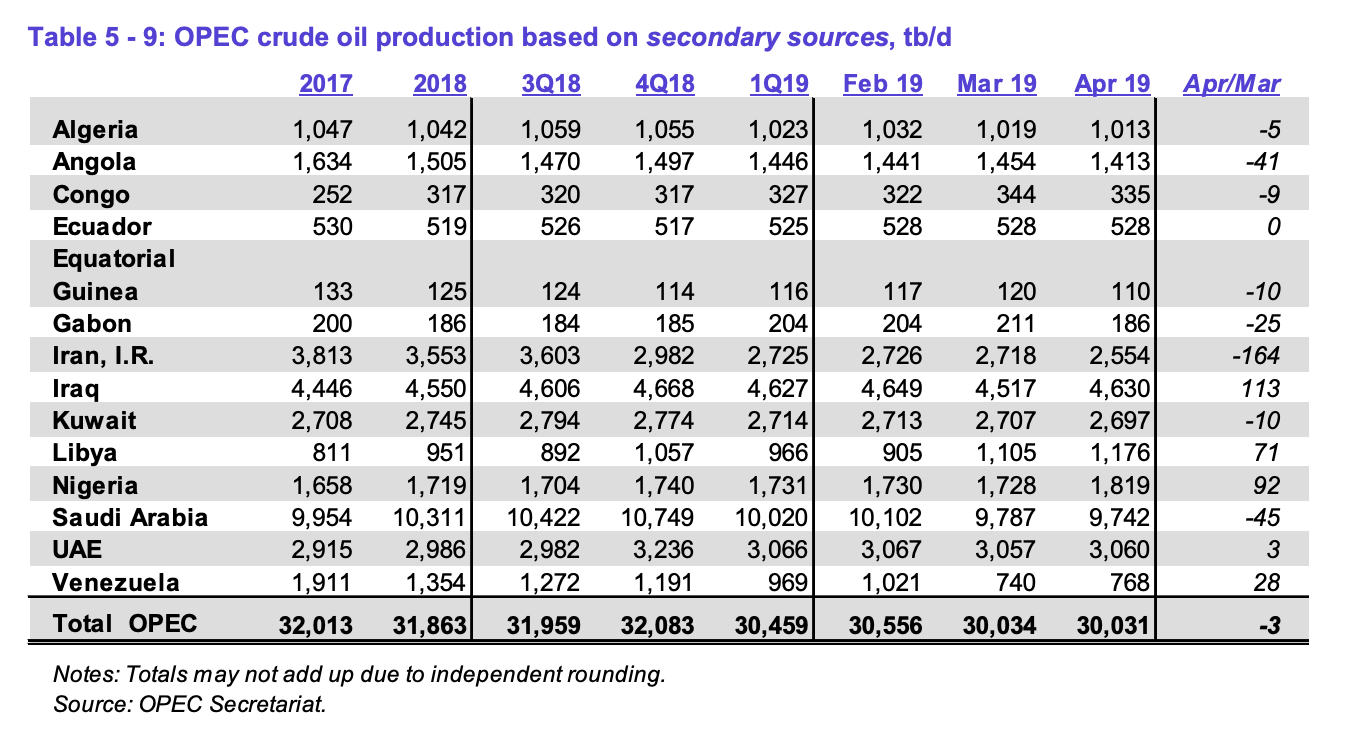

In the month of April, output by OPEC managed to average 30.031 million barrels per day, about 3,000 barrels per day lower than what was seen just one month earlier. This doesn’t mean, however, that each member nation saw its output flatline as well. Far from it. To get some look at the group as a whole and to look at each individual nation, please see the image below.

*Taken from OPEC

As you can see by looking at the image, there were a number of large swings from several of the group’s members. The most significant movement came from Iran, which saw its oil output decline 0.164 million barrels per day from 2.718 million barrels per day in March to 2.554 million barrels per day in April. This drop can almost certainly be explained by the ratcheting up of sanctions and the (realized) fear that waivers for certain nations buying crude from Iran would not be renewed. The only other big move on the downside during the month was Saudi Arabia, which produced 9.742 million barrels per day, 45,000 barrels per day lower than what we saw in March.

Even though these decreases were significant, other nations came in and made up for the declines. Leading the way was Iraq, which saw output climb 0.113 million barrels per day from 4.517 million barrels per day to 4.630 million barrels per day, nearly recovering from the drop seen from February to March. Libya and Nigeria saw their output climb 71,000 and 92,000 barrels per day, respectively, month-over-month, and even Venezuela, despite facing a substantial economic crisis, saw a modest uptick of 28,000 barrels per day (likely a recovery caused by the prior month’s decline of 0.281 million barrels per day that was in part created by temporary blackouts nationwide).

Over the next several months, it’s likely that output from Saudi Arabia will stay mostly flat (adjusted for any increases to cover for losses from Iran), but as recent news has indicated, there are heightened geopolitical risks caused by the Trump Administration’s harsh stance on Iran. Output in Iraq will probably grow some during this time, but nations like Libya, Nigeria, and especially Venezuela should see extreme volatility, with the first two nations seeing real upside and downside, while Venezuela’s path should be mostly toward lower output.

The balance is looking positive for oil bulls

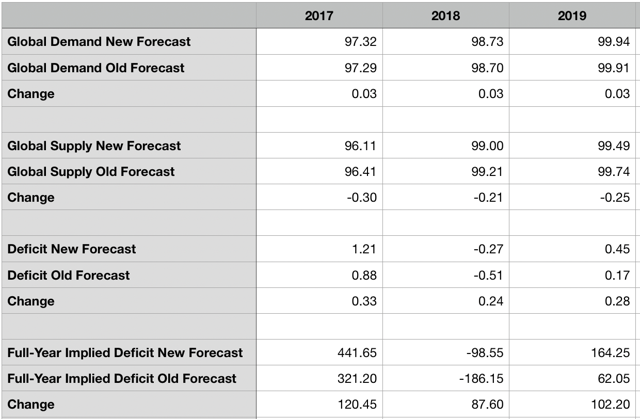

Almost no matter how you look at it, the picture for oil investors is undeniably bullish at this time. Without even taking into account Russia-related considerations that I wrote about in a prior article covering OPEC data that I still believe to be relevant, the world is either in a state of deficit or moving quickly toward it. To see this in detail, you need only look at the table below.

*Created by Author ( Daniel Jones )

As you can see here, global demand figures are looking a little more bullish (to the tune of 30,000 barrels per day for 2017, 2018, and 2019) compared to what was seen in the month of March. Supply, however, is looking far more appealing for bulls. In 2017, output was believed to have been 0.30 million barrels per day lower than it was estimated a month ago. This should translate to supply coming in 0.21 million barrels per day lower last year and 0.25 million barrels lower this year, all compared to prior forecasts. It’s worth mentioning that, for supply, I used OPEC’s first quarter results this year and then annualized April’s for the rest of this year, so significant changes from April’s production levels could have a material impact on crude balances.

As the table illustrates, these changes, particularly on the supply side, have major implications for global oil markets. Assuming all that OPEC has presented is accurate, the end result is exciting. Not only was the aggregate deficit in 2017 estimated to be 120.45 million barrels larger, globally, than previously anticipated, the excess output change last year of 87.60 million barrels is dwarfed by the 102.20 million barrel aggregate output change this year. On the whole, this year should see an aggregate deficit of 164.25 million barrels, bringing the global aggregate deficit between 2017 and 2019 to 507.35 million barrels, about 310.25 million barrels greater than what was shown a month earlier. Admittedly, most of this was used to take care of the glut that existed, but that issue is mostly gone and we are in a state where actual inventories might decline worldwide.

Takeaway

Based on the data provided, it appears as though the market is really looking up for oil bulls. Despite production rising globally, supply figures look appealing, and with OPEC’s output constrained, it looks highly likely that the market will only get better for bulls from here. Certain activities, like the economy slowing, or OPEC and some non-OPEC members (mainly Russia) reversing course, or US output rising even faster than anticipated, could change this for the worst, but absent one of these events transpiring, the bullish picture looks set to prevail.

Source: seekingalpha.com

More news

Ithaca Energy acquires Eni’s UK business in £750m deal

Iraq awards Akkas gas field development contract to Ukrainian firm

Seal of approval for UK oil & gas firm to expand its stake in Angolan offshore blocks

NZTC and NSTA Unveil Roadmap for Emissions Measuring and Monitoring Technologies